Why Financial Advisors Need Mindmaps

Financial advising and planning involve navigating complex data, developing comprehensive strategies, and presenting clear, understandable solutions to clients. With so many intricate elements to manage—ranging from investment options to tax planning and long-term financial goals—it can be challenging to maintain clarity and streamline communication. This is where mindmap tools become essential for financial advisors. By using visual aids to structure ideas and strategies, mindmaps help simplify intricate financial information, making it easier to identify key priorities and develop actionable plans.

Visualizing data through mindmaps allows financial advisors to break down complex concepts into manageable components, facilitating better client understanding. Instead of relying on lengthy reports or dense spreadsheets, mindmaps provide an interactive, intuitive way to present financial plans, highlighting relationships between different investment options and outlining clear pathways to achieve financial objectives. This enhances both client engagement and decision-making, ensuring that your strategies are easily understood and confidently executed.

Whether you’re mapping out investment strategies, tax planning, or retirement solutions, having a reliable mindmap tool can significantly improve your advisory services. Mindmaps not only help in organizing detailed financial data but also foster collaboration within your team. Advisors can leverage these tools to brainstorm ideas, connect different financial concepts, and ensure that all aspects of the plan are aligned with the client’s goals.

In this blog, we’ll explore some of the best mindmap tools specifically designed for financial advisors and planners, helping you choose the right solution to elevate your practice. By utilizing these tools effectively, you can streamline your planning processes, enhance client presentations, and ultimately deliver more value to your clients.

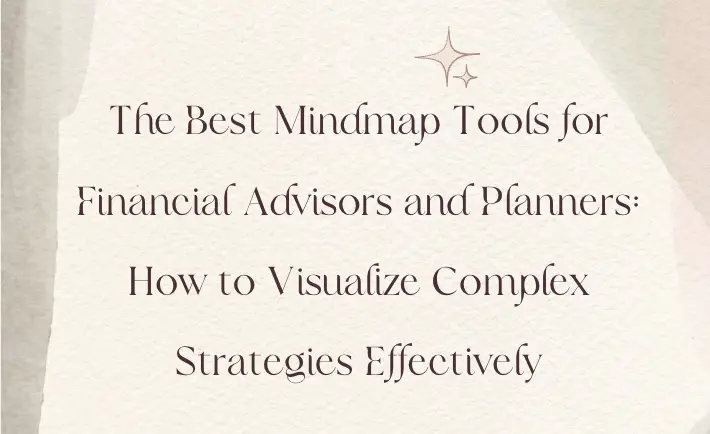

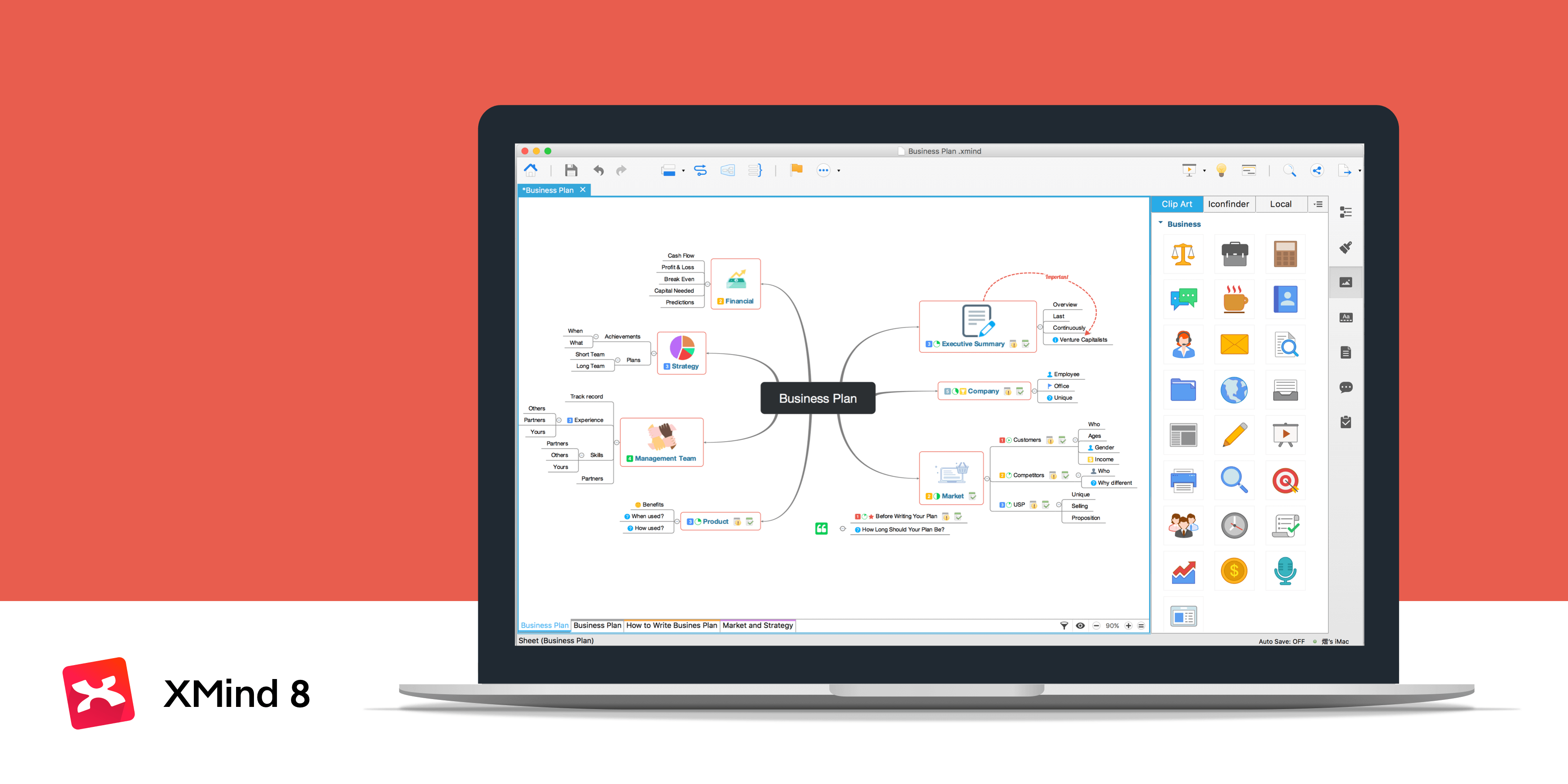

1. Xmind: Streamlining Financial Planning with Ease**

Xmind is a popular mindmap tool that stands out for its simplicity and flexibility, making it ideal for financial planners who want to break down complex information into manageable parts. Financial advisors can use Xmind to create structured layouts of investment plans, tax strategies, and financial roadmaps. Its intuitive interface allows you to include a variety of information, from asset allocation to retirement projections. This clarity helps clients visualize the long-term impacts of different financial decisions, making the planning process more transparent.

Additionally, Xmind’s robust export options enable you to share detailed plans with clients or integrate them into other business tools seamlessly. You can export mindmaps into various formats such as PDFs, PNGs, and even Microsoft Office documents, ensuring easy access and professional presentation. The rich customization features make it easy to tailor each mindmap to the specific needs of your clients, enhancing engagement and comprehension.

Key Features for Financial Advisors:

- Flexible layouts for tax and investment planning.

- Export options for integration with other business tools.

- Customizable designs for enhanced client engagement.

- Ability to create interactive maps that guide clients through decision-making processes.

Image from: Xmind

For financial advisors and planners working in teams or managing remote clients, MindMeister is an excellent option. This cloud-based tool allows you to collaborate in real-time, making it perfect for developing complex financial strategies that require input from multiple stakeholders. Advisors can work together on investment strategies, estate planning, or business succession plans from anywhere in the world, ensuring that every aspect of the financial plan is scrutinized and perfected.

Its integration with Google Drive, Microsoft Teams, and Slack makes sharing and editing mindmaps straightforward, while the ability to comment and add notes ensures every team member’s perspective is captured. Financial advisors will find the user-friendly interface useful for quickly structuring client plans, and the cloud storage capabilities allow for easy access to project updates. With MindMeister, you can also present your mindmaps directly to clients during virtual meetings, using the built-in presentation mode, adding a professional touch to your advisory sessions.

Key Features for Financial Planners:

- Real-time collaboration for remote teams.

- Integration with Google Drive, Microsoft Teams, and Slack.

- Commenting and note features for comprehensive strategy development.

- Built-in presentation mode for client meetings.

- Easy-to-use templates for common financial planning scenarios.

Image from: YouTube

3. Lucidchart: Ideal for Financial Flowcharts and Process Mapping**

Lucidchart is more than just a mindmap tool; it’s a powerful platform for creating detailed flowcharts, financial diagrams, and process maps. For financial planners handling multiple portfolios or complex client strategies, Lucidchart is perfect for visualizing cash flow, asset management structures, and long-term financial plans. You can map out intricate relationships between different investment products, estate planning options, or tax-saving strategies, offering clients a clear visual of their financial future.

The tool’s extensive library of shapes and templates lets advisors create comprehensive diagrams that are easy to understand for clients. This is particularly useful when explaining investment diversification, risk management, or tax-efficient strategies. Furthermore, Lucidchart’s collaboration features allow for real-time editing and feedback, making it easy to iterate and refine financial plans. The tool also integrates with CRM systems like Salesforce, making it easier to keep client information synchronized and up-to-date, ensuring no critical detail is overlooked.

Key Features for Financial Advisors:

- Extensive library for flowcharts and process diagrams.

- Real-time collaboration and feedback.

- CRM integration for client management.

- Templates for visualizing complex financial strategies.

- Ideal for mapping investment diversification and tax-saving strategies.

Image from: Quickbase

4. Coggle: Perfect for Personal Financial Planning**

For advisors focused on personal financial planning or smaller client bases, Coggle offers a straightforward way to outline detailed financial roadmaps. Coggle’s intuitive interface is ideal for mapping out budgeting plans, retirement savings paths, and debt management strategies. Its simplicity allows you to break down even the most complex financial data into digestible parts, which helps to build trust and transparency in your advisory practice.

The tool’s clean, minimalist design makes it easy to focus on the essentials without overwhelming clients with too much information. Additionally, Coggle’s color-coded branches help distinguish different financial elements, such as income sources, expenses, and investment returns, enabling clients to grasp the bigger picture effortlessly. You can also add rich media like images and links to supporting documents, ensuring that every plan is backed up by solid data and visual cues.

Key Features for Financial Planners:

- Minimalist design for clear financial roadmaps.

- Color-coded branches for easy differentiation.

- Rich media support for comprehensive financial planning.

- Ideal for budget and debt management plans.

- Simple sharing options for client communication.

Image from: Martech Zone

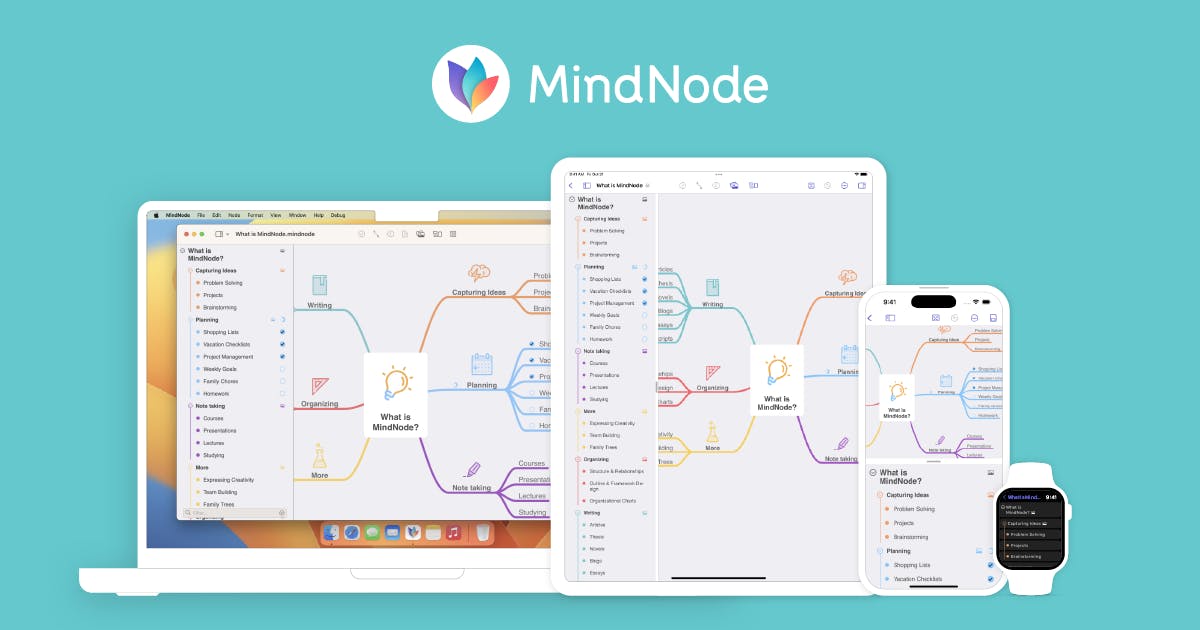

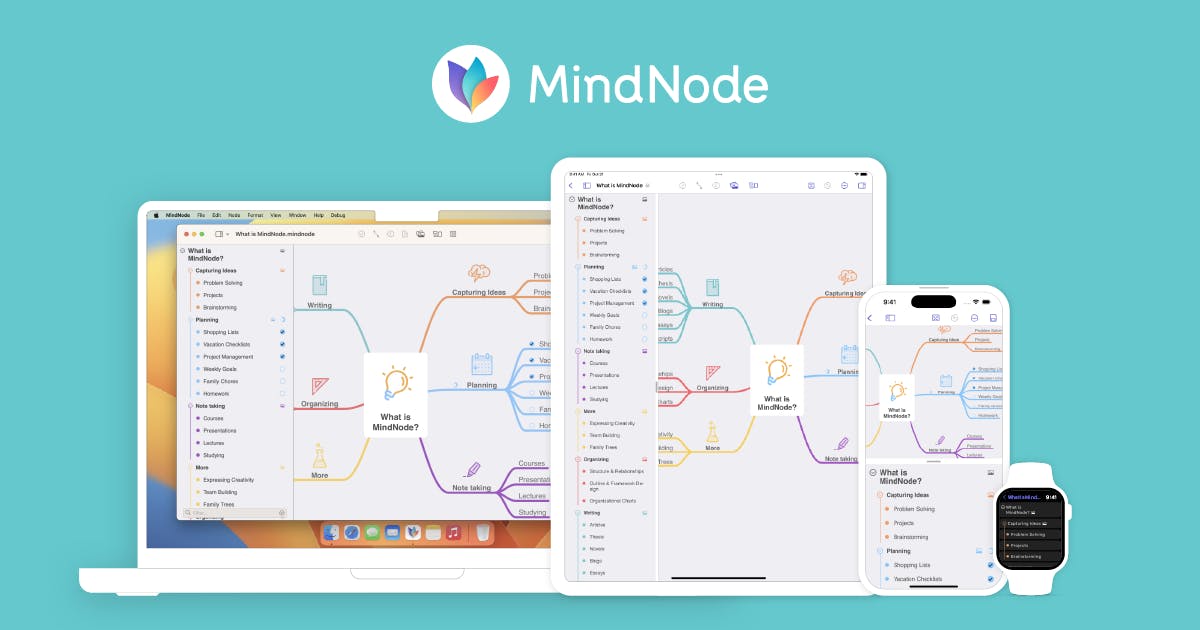

5. MindNode: Mapping Client Goals and Strategies Visually**

When it comes to mapping out complex financial goals and breaking them into achievable strategies, MindNode is a top contender. This tool is designed to turn vague ideas into clear action plans, making it ideal for advisors who focus on long-term financial goal-setting. Advisors can visually map out a client’s investment horizon, retirement goals, and estate planning, adding notes and reminders for detailed tracking. The ability to link related ideas and connect different parts of the plan helps clients see how each decision impacts their overall strategy.

MindNode’s task management capabilities allow you to create to-do lists, assign priorities, and set deadlines, helping both advisors and clients stay on top of financial plans. With its seamless cross-device compatibility, you can access your financial mindmaps from your Mac, iPad, or iPhone, ensuring your plans are always at your fingertips. The tool’s emphasis on clarity and organization makes it ideal for building a step-by-step guide that clients can follow to achieve their financial objectives.

Key Features for Financial Planners:

- Goal-setting and task management features.

- Cross-device compatibility for easy access.

- Visualizes long-term financial strategies.

- Links related financial elements for better clarity.

- Ideal for step-by-step financial planning and tracking.

Image from: mindnode

Selecting the right mindmap tool depends on the unique needs of your financial advisory practice. If you’re looking for a tool that offers real-time collaboration, MindMeister is your go-to option. For flowcharts and complex financial diagrams, Lucidchart provides unmatched flexibility. On the other hand, Coggle is perfect for simple personal financial planning, while MindNode excels at goal-setting and strategy visualization.

Xmind stands out for its ease of use and professional export options, making it a versatile choice for many different financial planning scenarios. By leveraging these mindmap tools, financial advisors and planners can create clear, actionable plans that are easy for clients to understand, ultimately enhancing client relationships and improving overall business outcomes.

Ultimately, the right mindmap tool will enable you to communicate complex financial concepts more effectively, streamline your planning processes, and offer a superior advisory experience that sets your services apart from the competition.

.9n5VrAjA_R5GjO.webp)